Mark Elzayed

The Signals Driving The Gold & Silver Rally You Need To Know

Gold and silver rally driven by macro repricing: real rates, central banks, geopolitics. We look at NST, EVN, RMS, SVL, IVR

Five Gold, Silver, and Copper Stocks for the Next Stage of the Cycle

For much of the past year, broad exposure to metals delivered strong returns. As 2026 progresses, that approach is starting to look blunt. Gold is holding firm for structural reasons, silver is behaving more like a strategic metal, and copper is increasingly defined by scarcity rather than cyclicality.

From Gold to Green Steel: We dive into TBR, GRR, JMS and More

The Australian share market has turned cautious again. Volatility has returned, sentiment has softened and many investors are stepping back. We see it differently.

Investor Pulse - Copper’s Multi-Year Opportunity Taking Shape on the ASX

The global copper market is entering a new era of structural tightness, with a number of factors creating what we see as one of the most compelling medium-to-long-term investment windows in years.

The Lithium Turnaround: Pilbara, Liontown, IGO, MinRes, and Global Lithium Resources to Watch

Australia’s lithium industry is entering an exciting period. Global demand for lithium is rising sharply, electrification is accelerating, and Australia’s hard-rock lithium producers are perfectly positioned to benefit. From rising export earnings to operational leverage and selective growth opportunities, the fundamentals are compelling. We’ve captured the full story in a detailed report, including: Why lithium […]

Australian Construction and Materials Sector at a Pivotal Moment: Public Spending Up, Private Activity Slowing

The Australian construction and materials sector is at an interesting crossroads. On one side, public investment is booming; on the other, private building activity is stumbling. Understanding this split is key to making sense of why some companies are thriving while others are struggling. Overall, the Australian construction market is projected to grow at a […]

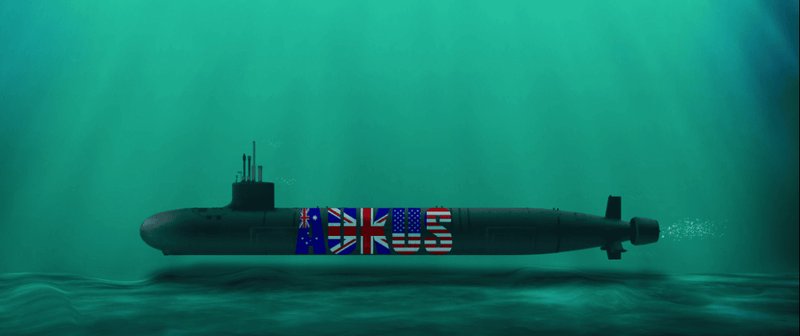

Rising Defence Budgets Create Momentum for ASB, BIS, EOS, DRO, and CDA

Special report from investorpulse.com.au – managed accounts that perform for a fraction of the price. Australia’s defence sector is undergoing a major transformation, with rising government spending, policy reforms, and international collaborations creating new opportunities for domestic firms. From naval shipbuilding and advanced technology projects to AUKUS initiatives, key programs are reshaping the industry. ASX-listed […]

Australia’s Small-Cap Moment: Industrials, Earnings Season, and 5 Stock Picks for 2026

Australia’s economy continues to show resilience – headline inflation is within target, GDP growth is solid, and the labour market remains strong. But the real opportunities for investors may lie beyond the mega-caps, in small- and mid-cap industrials trading at historic discounts. Our latest insights highlight companies like SRG, GNG, GNP, SHA, and DVP that […]