If one theme has come to define February for investors, it is this: growth remains visible, but the price of money is rising, and the era of easy policy support has clearly ended.

The decision by the Reserve Bank of Australia to lift rates to 3.85% was not cosmetic. It underscored that inflation risks are still present and that markets must adjust to operating without accommodative settings.

This article is the first in a three-part series examining our portfolio’s high conviction buys and why we believe they are positioned to navigate this more exacting backdrop.

Cash now offers credible competition; equity multiples face sharper scrutiny and earnings quality carries greater weight than momentum alone.

With trimmed mean inflation expected to peak at 3.7% in mid-2026 and bond markets braced for further tightening, the debate has shifted.

It is no longer about whether policy is restrictive. It is about which businesses can still widen margins, convert profit into free cash flow and sustain shareholder returns when capital is no longer cheap.

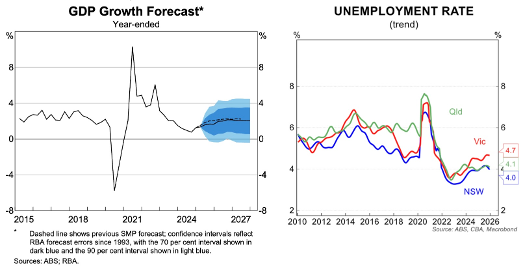

The Macro Setting: Strong, but Uncomfortable

Australia entered 2026 with momentum. GDP growth for 2026 is projected at 1.8% to 2.3%, above the economy’s sustainable pace, while unemployment at 4.3% remains historically tight.

Yet this strength carries its own risk. When demand pushes against limited capacity, inflation persists.

Services and housing pressures have broadened, forcing policymakers to act.

The International Monetary Fund (IMF) continues to describe Australia’s path as a soft landing, but it also warns of skewed risks. Global trade friction, geopolitical tension and volatile commodity markets mean forecasts carry wider error bands. Copper near $13,000 per tonne reflects structural tightness tied to electrification, while gold near $4,981 per ounce underscores investor anxiety.

For us, investors, the pain point is clear. How do we deploy capital when valuations are sensitive to rates and earnings downgrades can arrive abruptly? Our approach is to prioritise pricing power, capital discipline and exposure to structural scarcity rather than cyclical hope.

Telecommunications: Seeking Scale in a Cost-Heavy Sector

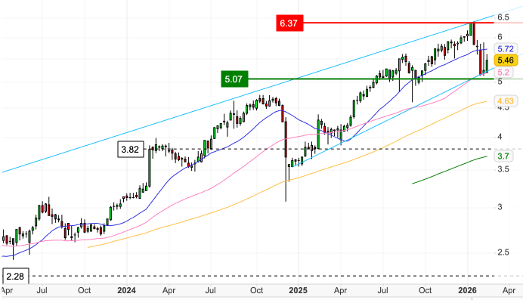

Source: ABB, weekly chart (2026)

Aussie Broadband has shifted decisively up a gear with the acquisition of telecommunications assets from AGL Energy.

In a higher for longer rate environment, we see scale as the most credible defence against margin compression and rising infrastructure costs.

By taking on roughly 350,000 broadband and mobile services, we are not simply adding volume, we are embedding an exclusive partnership that meaningfully reduces customer acquisition costs through AGL’s established distribution channels.

That lowers the need for heavy promotional spend at a time when smaller rivals are stretching balance sheets to compete. The result is a structurally stronger position as the clear number three player in the NBN market, with improved operating leverage and a broader recurring revenue base.

Attention now turns to the H1 FY2026 result on February 23, where we will be focused on integration milestones and progress toward the 12.5% EBITDA margin objective.

The deal’s financial architecture is attractive. Around $21mn in annualised EBITDA is expected within a year of migration, at an entry multiple of roughly 5.5x EBITDA, largely funded with scrip to preserve cash flexibility.

We want to see clean execution as services migrate onto owned infrastructure, because that is where the margin uplift crystallises. If integration proceeds smoothly, it materially de risks the Look to 28 strategy and reinforces the transition from agile challenger to utility scale operator with durable cash generation.

Technically, the stock’s response underscores that improving fundamental backdrop. The post announcement breakout through key moving averages signals a shift in momentum, while indicators remain supportive even as near-term conditions look somewhat extended.

We are comfortable with that set up because the technical strength is grounded in disciplined capital allocation.

Using equity as acquisition currency to secure high margin earnings in a consolidating market builds a moat that is difficult to replicate. In the current macro setting, we see Aussie Broadband combining operational execution, financial prudence and market share gains into a compelling, high conviction exposure within the domestic telecom landscape.

Mining Services: Capturing the Upswing Without Overextending

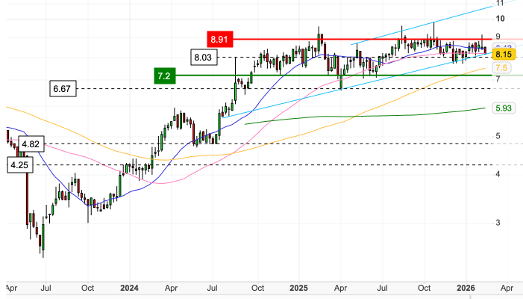

Source: MAH, weekly chart (2026)

Against a backdrop of volatile commodity markets and persistent anxiety over capital overruns, Macmahon Holdings distinguishes itself through operational discipline.

In H1 FY2026, revenue rose 11% to $1.3bn, but what stands out to us is the 21.2% Return on Average Capital Employed. That level of capital efficiency signals a business managing cost pressures and project execution more effectively than many peers.

Add to that a $25.6bn tender pipeline and we have rare forward visibility in a sector often defined by short cycles and uneven order flow. Importantly, that pipeline reflects active, high probability opportunities rather than aspirational targets.

Balance sheet management further reinforces the investment case. Net debt has been reduced to $144.1mn, with gearing at a conservative 17%, a prudent stance in a higher rate environment.

While revenue guidance of $2.6bn to $2.8bn is constructive, we are more focused on the strategic tilt toward margin stability. The ramp up of projects across Australia and Indonesia, particularly in underground mining and civil infrastructure, shifts the earnings mix toward higher margin and more technically complex work.

In our view, this is a deliberate move away from the traditional boom bust dynamic of mining services and toward a steadier, diversified revenue base aligned with the demands of value conscious capital.

Technically, the stock has delivered substantial long-term outperformance relative to the ASX 200, before consolidating from recent highs. We see the current pullback as constructive rather than concerning, with key support levels now being tested.

What gives us confidence is the underlying cash discipline, including a 95% cash conversion rate and an increased dividend, which together provide tangible underpinning.

Coupled with a $5.1bn order book and measured capital allocation, we believe Macmahon is positioned not merely to ride the current resources cycle, but to compound through it, making it a high conviction cornerstone within the portfolio.

Source: PRN, weekly chart (2026)

Perenti has moved decisively away from the growth at any cost mindset that has historically undermined returns in mining services. We see a clear emphasis on revenue quality and capital discipline.

The $1.1bn five-year contract at Mana and the $500mn extension at Agnew enhance earnings visibility, but the more telling development is the exit from subscale operations at Khoemacau in Botswana. That decision signals a willingness to walk away from capital that does not earn its keep.

By sharpening its focus on Return on Average Capital Employed, the group is prioritising margin resilience over volume expansion, a stance that resonates in a market increasingly attuned to capital efficiency.

Sustainability is embedded within that strategy rather than sitting alongside it. Through its Barminco division, Perenti is collaborating with Sandvik to roll out diesel electric underground equipment. These loaders and trucks are not simply a nod to decarbonisation.

They offer tangible productivity gains, lower maintenance intensity and improved fleet availability, particularly in deep mine settings where ventilation and fuel costs weigh heavily on margins.

As we approach the interim result on February 23, our focus is on whether strong revenue momentum and this technological edge are converting into durable free cash flow, sufficient to underpin the enhanced dividend policy and ongoing buybacks.

From a market perspective, the stock has delivered sustained strength over the past year, comfortably outperforming the broader resources cohort.

Even after consolidating from recent highs, the pattern of higher lows remains intact, suggesting underlying demand on pullbacks.

With a market capitalisation of about $2.5bn and earnings forecast to compound at roughly 23% over the next three years, we see a valuation that does not fully reflect the operational pivot under way.

For us, Perenti combines momentum characteristics with a more disciplined, de-leveraged balance sheet, a pairing that remains uncommon in diversified metals and mining services and underpins its place as a high conviction holding.

Source: SSM, weekly chart (2026)

Service Stream has steadily positioned itself as a recession resilient infrastructure operator, embedded within Australia’s essential utility and telecommunications networks.

With annual revenue of $2.32bn and a free cash flow yield of 8.6%, we see a business offering a tangible margin of safety at a time when discretionary demand remains fragile.

The $1.6bn six-year contract with the Department of Defence is transformative. It broadens the revenue mix and introduces a multi-year, annuity style income stream that is largely insulated from swings in consumer sentiment.

In our view, this deeper exposure to secure government work strengthens its role as a core provider of national infrastructure and reinforces its defensive credentials.

The half year result on February 25 will be an important checkpoint. A forward P/E of around 23.6x implies confidence in execution, particularly around the mobilisation of the Defence contract, which commenced on February 1.

We will be looking closely at margin trends as labour costs remain elevated, and at the sustainability of the dividend following the recent increase of more than 20%. While the multiple is not conventionally inexpensive, the company’s record of more than 100% cash conversion and a net cash position exceeding $73mn support the case for a quality premium.

In a small to mid-cap universe where dependable yield is scarce, those attributes matter.

From a market perspective, the stock has outperformed the ASX 200 over the past year and is now consolidating after a strong run.

Support around key moving averages suggests the broader uptrend remains intact despite modest year to date weakness. We regard this consolidation as constructive.

With rising institutional participation and consistent contract renewal rates, we believe Service Stream offers growth at a reasonable price characteristic underpinned by a robust balance sheet.

As long as capital allocation remains disciplined and retention stays high, the risk reward profile continues to favour upside, particularly in a market that increasingly values essential, repeatable cash flows.

Ventia Services Group (ASX: VNT)

Source: VNT, weekly chart (2026)

Ventia Services Group continues to demonstrate how long-standing public-sector relationships can be converted into high visibility earnings.

The recent $100mn NSW Whole of Government cleaning contract in Western Sydney builds on a two-decade track record and underscores the advantage of scale in essential services.

In a tighter fiscal climate, where discretionary infrastructure outlays face scrutiny, we see Ventia’s concentration on maintenance, defence and asset management as a structural buffer.

Alongside the $2.7bn Base Services Transformation packages for the Department of Defence, the revenue mix is tilting further toward long duration, government backed work. That stickier earnings base reduces volatility relative to project driven peers.

With FY2025 results due on February 18, capital management is central to the debate. The expansion of the on-market buyback from $100mn to $150mn signals confidence in cash generation and balance sheet strength.

Wage inflation and labour availability remain sector wide constraints, yet an 8.3% EBITDA margin suggests operational discipline is offsetting cost pressures. We also note the strategic emphasis on higher margin telecommunications and energy services, which should gradually enhance returns.

At roughly 18.9x earnings and a 3.9% yield that has grown consistently since listing, the stock offers a blend of defensiveness and measured growth that remains attractive in a yield conscious market.

From a market standpoint, Ventia has outperformed the ASX 200 over the past year, before entering a period of consolidation from recent highs.

The current test of long-term support levels appears orderly rather than disorderly, in our assessment.

What anchors our conviction is the 95% inflation pass through embedded in contracts and a record $20.6bn work in hand, which together provide a durable earnings floor.

In an environment defined by macro uncertainty, we see Ventia’s annuity style cash flows and disciplined capital returns as a stabilising force within the portfolio, without relinquishing momentum.

Source: EHL, weekly chart (2026)

Emeco Holdings has materially reduced balance sheet risk following the $355m refinancing of its debt facilities in late 2025. By replacing near term notes with a five-year revolving syndicated facility at improved pricing, we see the group insulating itself from rate volatility and extending maturity headroom.

That flexibility is crucial in a capital-intensive industry.

Fleet utilisation across gold and copper remains firm, supporting the core rental franchise, yet the more interesting shift is toward the Force Workshops division. This higher margin, lower capital maintenance business diversifies earnings and reduces reliance on pure fleet expansion.

The H1 FY2026 result on February 19 will be a key test of execution. We will be looking for clear evidence that cost pass through mechanisms are offsetting labour and maintenance inflation as activity levels remain elevated.

Recent trading commentary has been constructive, but margin stability is what ultimately matters. The strategy outlined at Investor Day, centred on technology integration and a greater weighting to maintenance services, is designed to lift Return on Capital Employed while easing capital intensity.

If revenue momentum converts into stronger free cash flow, it would confirm Emeco’s transition toward a more efficient, utility like service provider to the mining sector.

From a market perspective, the stock has maintained solid upward momentum and continues to trade above key long-term moving averages, even after a period of consolidation near recent highs.

We interpret that base building as constructive. On a multiple below 10x earnings and with one of the more compelling free cash flow yields in the mid cap industrial cohort, valuation remains supportive.

When we combine improved debt pricing, sustained demand for rental equipment and disciplined capital allocation, Emeco stands out as a value with momentum opportunity that warrants high conviction positioning within the portfolio.

Source: DOW, weekly chart (2026)

Downer EDI has given tangible substance to its turnaround through a series of transport and infrastructure wins, most notably the NZ$870m New Zealand state highway maintenance contracts due to commence in May 2026.

These long-dated agreements anchor multi-year revenue and reinforce its Trans-Tasman footprint. For us, the more important shift is structural. After an intensive period of restructuring and tighter risk controls, the group has repositioned toward lower risk, government backed service work.

The narrative has moved from balance sheet repair to margin expansion, with management targeting a 6% EBITA margin by FY30, a level that would mark a clear step up from prior cycle returns.

The H1 FY2026 result on February 19 will be the next proving ground. Gross margins of 11.5% underline the competitive nature of the sector, yet a Piotroski score of 8 points to measurable improvements in profitability, leverage and liquidity.

A $35.1bn work in hand position provides substantial earnings visibility and supports guidance despite ongoing wage inflation.

We are also focused on the Energy and Utilities division, where exposure to the energy transition and ageing water assets offers a higher margin complement to the steadier transport book. That mix evolution is central to lifting group returns over time.

From a market standpoint, the stock has outperformed the ASX 200 over the past year and is now consolidating after reaching multi year highs.

We view this pause as constructive within a broader uptrend. Capital management adds another layer of support, with a $150mn on market buyback and a fully franked yield of about 3.2%.

On a forward multiple that remains reasonable relative to forecast earnings growth of nearly 20%, Downer offers a blend of recovery driven expansion and defensive infrastructure exposure that justifies high conviction positioning in the portfolio.

Universal Store Holdings (ASX: UNI)

Source: UNI, weekly chart (2026)

Universal Store Holdings has established a defensible position in the domestic apparel market by concentrating on youth oriented, casual fashion with a curated brand mix.

In a trading environment shaped by cost-of-living pressures, the group delivered FY2025 revenue growth of 15.5% to $333.3mn, supported by the continued rollout of its Perfect Stranger concept and the integration of THRILLS.

Headline margins softened, with net profit margins easing to 7.0% from 11.9%, reflecting a one-off impairment and higher cost of goods sold. Stripped of those factors, underlying metrics remain robust.

A gross margin of 61.1% and return on capital employed of 25% indicate pricing discipline and efficient inventory management, particularly notable in a sector where peers have relied on discounting to stimulate demand.

The February 19 H1 FY2026 result will be closely watched for confirmation that strong late 2025 momentum has translated into steadier EBIT margins. Group direct to consumer sales rose 13.7% across the first 17 weeks of the period, suggesting demand has held up into the new financial year.

Management plans to open between 11 and 17 additional stores, while expanding higher margin private labels such as Neovision, which now accounts for 18% of core sales. That mix shift should support margin recovery if execution remains disciplined.

From a valuation standpoint, the shares offer a free cash flow yield of roughly 9.5% and trade on about 10.5x price to free cash flow, a level that provides a degree of earnings support in what is often a volatile discretionary segment.

The stock recently traded in the $8.30 to $8.50 range after easing from January highs of $9.16 and remains above its 200-day moving average with momentum indicators suggesting scope for further upside before reaching stretched territory.

Relative performance has been competitive within the broader retail cohort of the ASX 200.

With a 4.7% fully franked dividend yield, no bank debt and exposure to a clearly defined demographic niche, Universal Store presents as a disciplined growth operator trading on undemanding multiples.

Should upcoming results confirm stabilising margins and continued sales traction, the case for a rerating toward consensus targets in the $9.90 to $10.30 range would strengthen materially.

Discipline as the Common Thread

What binds these holdings together is not sectoral similarity, but financial character.

In an environment where the Reserve Bank of Australia has lifted the cash rate to 3.85% and inflation remains stubborn; capital is no longer forgiving.

Earnings must convert into cash. Growth must be funded responsibly. Balance sheets must absorb shocks rather than amplify them.

Our first article has outlined the core of our high conviction positioning across telecommunications, mining services, infrastructure and selective consumer exposure.

In each case, we see evidence of pricing power, order book visibility or structural tailwinds that extend beyond the immediate cycle. Just as importantly, we see management teams increasingly focused on Return on Capital Employed, free cash flow and disciplined capital allocation rather than expansion for its own sake.

In the pieces that follow, we will examine the remaining high conviction buys held in our portfolio and assess how they complement this foundation.

The objective is not breadth for its own sake, but coherence. In a market where proof outweighs promise, conviction must rest on resilience.