Hot Topics

Trending stories and market-moving news from the ASX small-cap sector

Weekly Wrap: Late pullback slams gold shares

ASX slips 0.7% as late pullback drags gold shares lower on Fed chair speculation; bullion drops ~5% amid rate-hike fears.

Top Stories

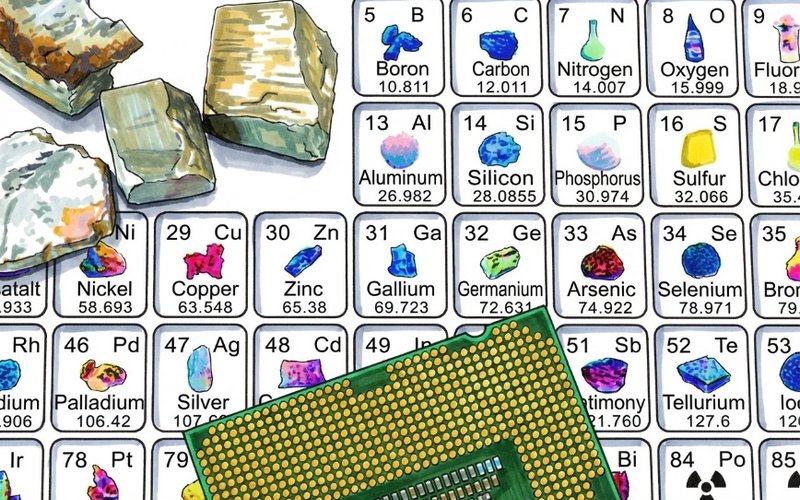

China’s Midstream Metals Dominance Sparks Strategic Alarm

China controls 50-98% of midstream refining and smelting, sparking Western strategic alarm; ASX rare-earth stocks surge as Australia positions itself.

The Signals Driving The Gold & Silver Rally You Need To Know

Gold and silver rally driven by macro repricing: real rates, central banks, geopolitics. We look at NST, EVN, RMS, SVL, IVR

Productivity Takes a Holiday

Productivity Commission delivers 47 reform recommendations for Australia: tax tweaks, upskilling, and data reforms that could boost GDP billions if acted on.

Latest Hot Topics

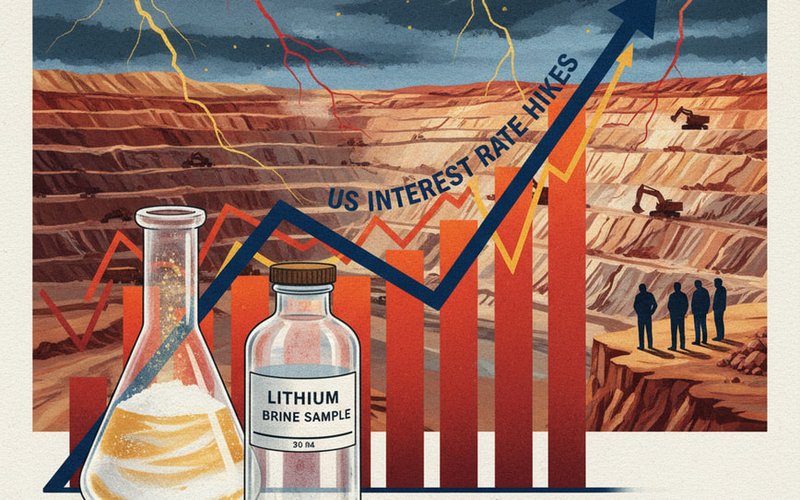

Rate Rise Looking More Likely

Dollar climbs as unemployment hits 4.2% and rate-hike bets surge ahead of CPI release; trimmed-mean at 3.2% could force Feb/Mar rise.

Weekly Wrap: Rising rates lift AUD and gold as miners lead ASX gains

Gold hits fresh highs and miners rally as rates rise; Life360 soars on upbeat guidance, AUD hits 16-month peak, ASX 200 slips 0.5% for the week.

Five Gold, Silver, and Copper Stocks for the Next Stage of the Cycle

For much of the past year, broad exposure to metals delivered strong returns. As 2026 progresses, that approach is starting to look blunt. Gold is holding firm for structural reasons, silver is behaving more like a strategic metal, and copper is increasingly defined by scarcity rather than cyclicality.

From Gold to Green Steel: We dive into TBR, GRR, JMS and More

The Australian share market has turned cautious again. Volatility has returned, sentiment has softened and many investors are stepping back. We see it differently.

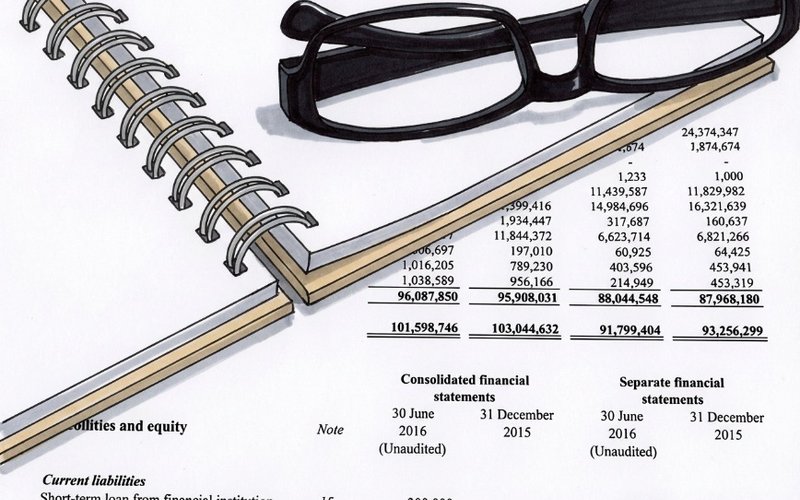

Retirees Flock to Generous Downsizer Contributions

One of the hidden secrets of quickly increasing superannuation accounts is really starting to get some traction, with figures released by industry fund HESTA showing that the use of downsizer contributions to beef up superannuation balances increased a lot in 2025.

Trump’s Failure Clear From Just Two Numbers

There are always plenty of debates about the success or otherwise of US President Donald Trump; however, you only need to look at two simple numbers to demonstrate his absolute failure, at least in the short term, on two key economic areas—trade and the economy.

Weekly Wrap: Winning Streak Persists as Tech, Banks Drive Aussie Shares

ASX 200 rises 0.5% to 8,903 as tech and banks lead; miners retreat, with Capstone Copper and Catalyst Metals rallying on strong results.

Separately Managed Advantages

With increased taxes on high superannuation balances, a lot of people are talking about alternative structures for keeping their investments, including a niche product known as a Separately Managed Account.