What would help you to engage more with your superannuation fund?

Would a rash of emails do the trick, a host of good retirement calculators on the website or perhaps direct contact from an actual person asking if you need advice about your superannuation?

It turns out none of these strategies work that well according to some of the most recent research, although it could be argued that the direct and personal approach remains untried.

Super Rewards?

What really does work for increasing member engagement, according to ASX-listed customer engagement firm Gratifii (ASX: GTI), is offering tangible rewards and benefits that can lead to meaningful and repeatable interactions with the Super fund.

According to a whitepaper released by Gratifii, current superannuation funds' efforts to lift digital capabilities and implement engagement strategies via emails or dashboards are not doing the job.

To foster real engagement, super funds needed to show that they are relevant and can establish emotional connections.

One of the ways it suggests to do this is by offering members tangible rewards or lifestyle benefits that can be used straight away—a bit like the awarding of points such as those used in frequent flyer programmes.

This approach is being tried by a few super funds, with AMP and QSuper both using a customer engagement strategy.

Other funds have also introduced member benefits schemes that offer a series of discounts for retail, travel and entertainment services.

Engagement Leads to Positive Change

Once the member is engaged with their fund, getting them to make some changes such as regularly updating their death benefit beneficiary, making real preparations for retirement or updating their investment risk profile becomes easier.

As the white paper put it:

"When members can access real-world savings on groceries, fuel, entertainment or experiences, their relationship with their fund begins to shift. Instead of seeing super as something they will benefit from in 30 years, they can experience it as something that delivers value today."

Playing Games Could Also Work

Gamification is another way that can lead to more positive interactions and better member engagement.

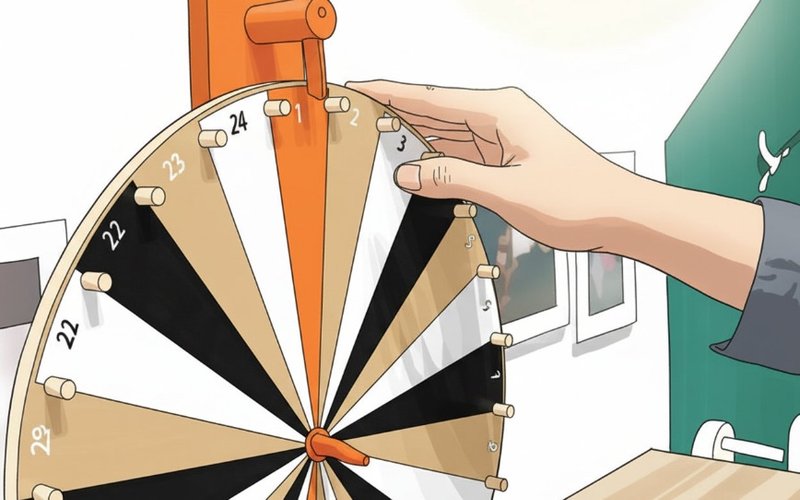

This might involve progress tracking, rewards, badges, challenges or even simple Temu style engaging mechanics like 'spin and win'.

"Creating quick, rewarding touchpoints like a daily finance-themed based Wordle, or a short quiz that unlocks a perk gives members a reason to engage more often.

These light interactions can also nudge small, positive actions with their fund," Grafitii suggested.

These sort of interactions can lead to members logging in to their portal or app and interacting with their fund more often.

Grafitii chief executive and managing director Iain Dunstan said it is not about turning super into entertainment—it's about meeting members where they are and making super feel more relevant, more often.

Rewards Can Be a Bridge

"Some in the industry may worry that rewards can distract from the core purpose of superannuation.

But used strategically, rewards are a bridge.

Every time a member logs in to redeem a discount, there is an opportunity to engage in a positive way," he said.

"When a super fund nudges a member with wanted rewards content, there is an opportunity to deliver an update, share educational content or guide them toward a deeper understanding of their super."