John Beveridge

John is a highly experienced business journalist and formerly chief business writer for the Herald Sun. He has covered Federal politics in Canberra, was Los Angeles Bureau chief for News Limited and was also chief of staff for the Herald Sun. He has covered a wide range of small and large cap ASX stocks and has a special interest in mining, technology and biotech.

Weekly Wrap: Late pullback slams gold shares

ASX slips 0.7% as late pullback drags gold shares lower on Fed chair speculation; bullion drops ~5% amid rate-hike fears.

Productivity Takes a Holiday

Productivity Commission delivers 47 reform recommendations for Australia: tax tweaks, upskilling, and data reforms that could boost GDP billions if acted on.

Rate Rise Looking More Likely

Dollar climbs as unemployment hits 4.2% and rate-hike bets surge ahead of CPI release; trimmed-mean at 3.2% could force Feb/Mar rise.

Weekly Wrap: Rising rates lift AUD and gold as miners lead ASX gains

Gold hits fresh highs and miners rally as rates rise; Life360 soars on upbeat guidance, AUD hits 16-month peak, ASX 200 slips 0.5% for the week.

Retirees Flock to Generous Downsizer Contributions

One of the hidden secrets of quickly increasing superannuation accounts is really starting to get some traction, with figures released by industry fund HESTA showing that the use of downsizer contributions to beef up superannuation balances increased a lot in 2025.

Trump’s Failure Clear From Just Two Numbers

There are always plenty of debates about the success or otherwise of US President Donald Trump; however, you only need to look at two simple numbers to demonstrate his absolute failure, at least in the short term, on two key economic areas—trade and the economy.

Weekly Wrap: Winning Streak Persists as Tech, Banks Drive Aussie Shares

ASX 200 rises 0.5% to 8,903 as tech and banks lead; miners retreat, with Capstone Copper and Catalyst Metals rallying on strong results.

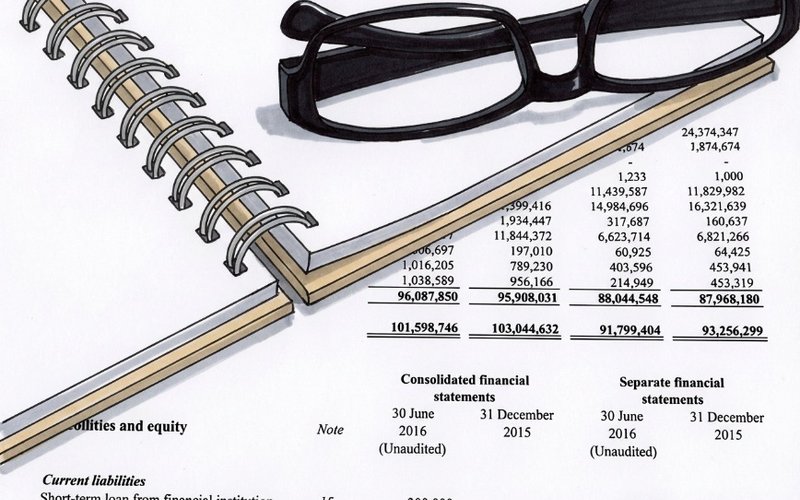

Separately Managed Advantages

With increased taxes on high superannuation balances, a lot of people are talking about alternative structures for keeping their investments, including a niche product known as a Separately Managed Account.

The Key Number to Watch for Interest Rate Rises

There is endless speculation about which direction official interest rates are heading in Australia and how far and fast they will rise and fall.

Weekly Wrap: Markets edge as Rio-Glencore talks spark change in mining bid

Rio Tinto slides 6% on Glencore all-stock merger talks; BlueScope up 2% after rejecting a $30 offer. ASX 200 drifts -0.1% as deal news dominates.

ASX ends New Year modestly higher as energy offsets losses

ASX 200 closes up 0.2% as energy leads gains; uranium miners surge, DroneShield rebounds. CPI data this week could set rate expectations.

Trump Tariffs, AI Boom Rewrite 2025 Markets Worldwide

Trump’s tariff turmoil roils markets in 2025, but AI-led rally lifts global equities and the ASX ~14% from April lows.

Retirees Could Shoulder CSLR Costs as Super Tax Windfall Grows

Super taxes soar: extra $10.9b to the budget, $4.3b in 2025-26, driven by wages and 15% accumulation tax; CSLR levy reform eyed.

New super rules tax earnings for large balances, up to 40% on $10m+

Australian super rules tax earnings on large balances, up to 40% for $10m+, with unrealised gains removed; effective July 1, 2026; industry to consult in Jan.

Mortgage trap in later life: housing debt keeps Australians working longer

Australians risk retirement as property wealth masks crippling debt: half of 55–64 homeowners owe housing debt; average >$230k, pension gap widening.

Weekly wrap: A modest rise to end the week

The Australian share market enjoyed a modest rise to end the week on Friday after a Wall Street rally caused by optimism of more interest rate cuts in the future.

The ASX 200 index closed up 0.5%, or 40 points, to close on 8628.2 points after eight of the 11 sectors rose.

Diverging Rates Pushing Up Aussie Dollar

At last the long-anticipated diverging interest rate outlook between Australia and the US is a reality and we can begin to see the effects it is already having.

A Helping Hand in Getting on the Property Ladder

The latest government housing market program that you may not have heard about is known as "help to buy" and it works by the government directly taking a stake of up to 40% in the property you buy.

Weekly Wrap: ASX Climbs on Santa Rally as Miners and Gold Stocks Lead Gains

The Santa rally arrived in earnest on the Australian stock exchange as the share market rose the most in almost three weeks on Friday.

A continuing rise in gold stocks and strong gains in miners happened as investors jumped aboard the US interest cuts train, hoping that it was creating a rising market tide that would lift all boats.

More Government Makes Houses Less Affordable

A report from property data firm Cotality shows the extent of the damage over a period in which governments at all levels made rash and so far largely unfulfilled promises about dramatically increasing housing supply.