China’s lithium carbonate futures ripped to their highest levels since June 2024 in mid–late November, capping a >17% month rally and briefly hitting the daily limit up.

The move wasn’t just noise: it united three powerful forces, tighter near-term supply, stronger multi-year demand signals (EVs + grid storage), and bullish guidance from tier-one producers, and it may mark the start of a new pricing regime into 2026.

Below, we break down what’s changed, and why this matters for Australian lithium, a segment the market has largely overlooked while chasing gold, silver, copper and “critical minerals” baskets.

What Lit the Fuse in China

1. Ganfeng’s demand call

Ganfeng’s chair flagged 30–40% lithium demand growth in 2026, adding explicit price waypoints (150,000–200,000 RMB/t for carbonate). That’s unusually specific guidance from an industry heavyweight and helped reset expectations across the curve.

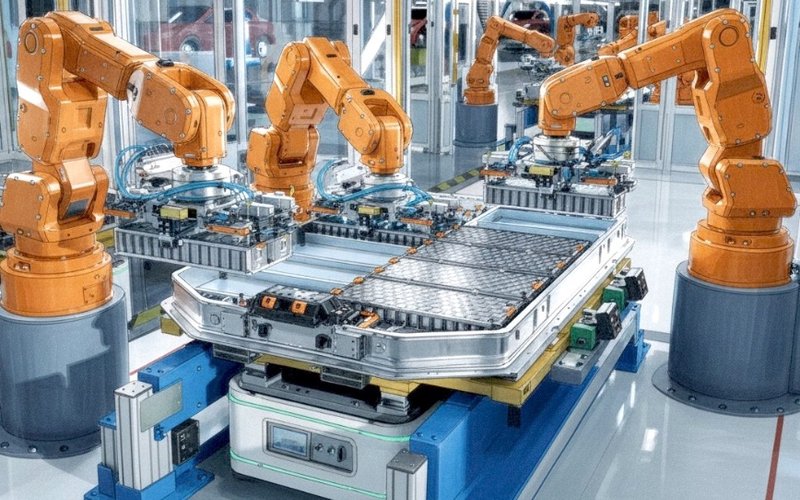

2. Energy storage steps out of EV’s shadow

Large-scale batteries for the grid are now a second leg of structural demand. Storage procurements (often contracted on longer terms) tighten the market alongside EV growth, supporting higher base-load consumption for carbonate and hydroxide.

3. Supply friction

Operational hiccups (including a high-profile mine shutdown in Jiangxi) and a heavier domestic-priority stance have pinched Chinese spot availability, forcing processors to compete for feed and amplifying price sensitivity.

4. Futures and flows

Guangzhou futures hit limit-up after the Ganfeng commentary, confirming institutional re-risking to lithium exposure and re-rating of integrated processors and refiners.

How High Could Prices Go?

- Spot checkpoint: ~95,200 RMB/t on the move (upper limit day), the highest since June 2024.

- Implied upside band (producer guide): 150k–200k RMB/t if 2026 demand plays out and supply growth lags.

- What would support that band? Stronger energy-storage awards, EV production stability, and slower-than-forecast supply additions (or qualification bottlenecks for new capacity).

Why it Matters for Australia

For most of 2025, investors rotated toward gold, copper and “critical minerals” themes; lithium saw multiple compression and selective funding pressure, despite Australian assets offering jurisdictional stability, ESG transparency, and an established path to OEM-grade supply.

If China’s rally is an early read-through on 2026, ASX lithium could be next in line:

1. Price elasticity on Australian feed

Even modest lifts in carbonate/hydroxide benchmarks expand margins quickly for hard-rock spodumene producers and projects approaching FID.

2. Contracting and qualification cycle

A firmer price backdrop often pulls forward offtake negotiations, helps convert MOUs to binding deals, and improves bankability (debt headroom, equity confidence) for brownfield expansions and late-stage developers.

3. Cost and FX tailwinds

A weaker AUD vs USD/RMB can enhance realised margins for Australian exporters in an upswing, especially where logistics are already locked in.

4. Storage opens a second demand door

Developers tied to hydroxide or able to pivot products may benefit as grid-storage specifications broaden accepted chemistries and quality ranges, diversifying end-markets beyond EVs.

Who Could Feel it First

- Operating spodumene producers with room to crank throughput or recoveries.

- Late-stage developers with permitting, engineering and offtake advanced, most leveraged to a price reset.

- Refining/chemicals entrants in WA with credible feed and financing plans, higher prices can close funding gaps.

- Mid-tier explorers with scale and grade where a higher incentive price revives the economic case.

What to Watch from Here

- Contract prints & offtake revisions: Do we see tighter terms, higher floors, or wider premia for qualified supply?

- Qualification bottlenecks: New supply needs time in the lab; delays here stretch the tightness.

- China policy temperature: Domestic-first allocation vs export flexibility will steer spot volatility.

- Storage procurement cadence: Utility-scale awards into 2026 are the second engine of demand.

- Australian financing cadence: Are FIDs/DFS timelines pulling forward as price decks move up?

Risks that Can Still Derail a Bull Move

- Overshoot on supply: Faster-than-expected ramps, DLE step-ups or rapid restarts can cool prices.

- EV demand wobble: Macro or model-cycle air pockets could dent near-term cathode orders.

- Chemistry shifts: Lower-lithium-intensity designs or substitution (at the margin) would trim unit demand.

- Policy shocks: Export controls, tariffs or credit tightening can whipsaw sentiment.

Bottom Line

The late-2025 China rally looks less like a dead-cat bounce and more like an early inflection toward a tighter 2026, powered by EV + grid storage.

For Australian lithium, which has been overshadowed and de-rated through much of 2025, this may be the leading indicator that the tide is turning.

If pricing holds and offtake momentum follows, expect capital to rotate back down the lithium curve, from mega-caps back toward ASX producers, late-stage developers and quality explorers whose valuations have lagged the fundamentals.