++Red Mountain Mining (ASX: RMX)++ has strategically positioned itself to leverage off strong Australian and US government interest in securing critical mineral supply chains with the acquisition of a number of priority projects during the September quarter.

The company has acquired 87 claims within Utah’s antimony mining district that lie immediately along strike to the north and south of Trigg Minerals’ (ASX: TMG) Antimony Canyon project approximately six kilometres north of the main prospect, which includes more than 30 small historical mine workings surrounding the Antimony and Drywash canyons.

Red Mountain plans to use high-resolution drone magnetics and surface reconnaissance mapping at its claims to locate undercover extensions of structures at Antimony Canyon and Drywash Canyon.

Yellow Pine Acquisition

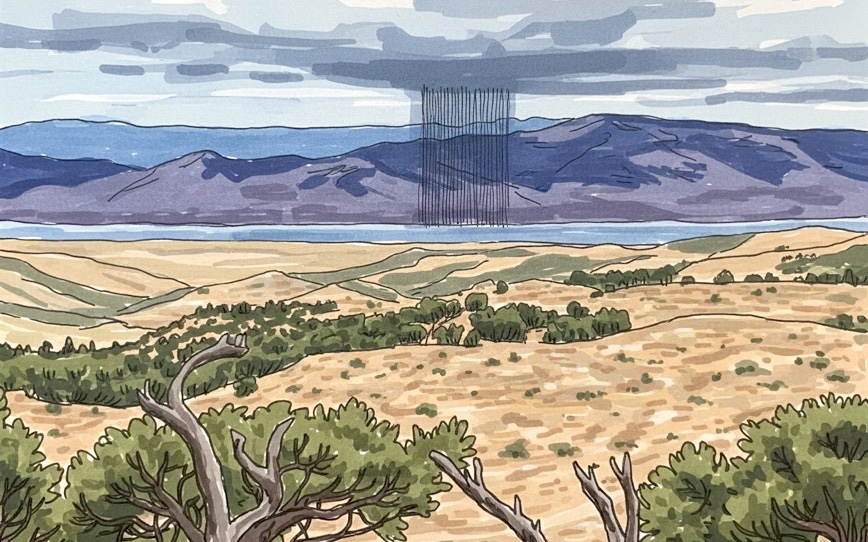

During the period, Red Mountain also acquired the Yellow Pine antimony project within the prolific Stibnite mining district in central Idaho.

The project’s Yellow Pine and Hangar Flats deposits produced 39,930 tonnes of antimony between 1932 and 1952 just 5km south of Resolution Minerals’ (ASX: RML) Horse Heaven antimony project.

Initial exploration will focus on mapping and sampling of the main north-to-northeast-trending fault through the project area as well as the intrusive contact between the Idaho Batholith granites and metasedimentary units to demonstrate evidence of hydrothermal fluid flow, brecciation, alteration and antimony-gold mineralisation.

Armidale Project Exploration

Red Mountain continued to aggressively explore its Armidale antimony-gold project in New South Wales through investigation and sampling of historical mineral occurrences, as well as using multispectral satellite data to highlight new prospects.

Initial soil and rock chip sampling over the East Hills prospect in Armidale’s southern portion confirmed the presence of high-grade mineralisation, with a best result of 9.9% antimony.

A further two samples with anomalous antimony the company collected 70m along strike from the mineralised sample suggest that antimony mineralisation at East Hills extends beyond the small historical workings.

Flicka Lake and Kiabye Work

Red Mountain engaged Fladgate Exploration Consulting to conduct sampling across three high-grade gold-bearing quartz reefs at the Flicka Lake claim within its Fry Lake gold-copper project in Canada.

Fry Lake has seen only limited previous exploration and has significant potential for undiscovered orogenic gold and possible base metal mineralisation.

Meanwhile, a maiden reverse circulation drilling program at the Kiabye gold project in Western Australia identified a second area of alluvial nuggets, after the earlier discovery of six rounded nuggets weighing a total of 13.1 grams.

Corporate Activity

Post-quarter funding helped boost Red Mountain’s balance sheet and provide funds for exploration and continued growth with an oversubscribed $1.5 million share placement in September.

This followed a $650,000 placement in July that secured backing from three strategic investors who are Top 20 shareholders of Larvotto Resources (ASX: LRV), along with an options entitlement issue to raise approximately $193,499 before costs.

The company has disclosed plans to pursue a US stock market listing that will allow it to access further capital and liquidity across the Australian and North American markets.

“Our continued investment in the US capital markets offers a significant opportunity to unlock the value of our assets and engage with critical minerals supply chain experts and investors,” the company said.

It remains open to assessing new project opportunities and is continually reviewing its existing portfolio to identify potential high-value critical mineral assets.