Pacific Lime and Cement (ASX: PLA) has secured a long-term quicklime offtake agreement with Newmont Corporation for supply from its Central Lime project in the Central Province of Papua New Guinea.

The agreement establishes Newmont as a cornerstone customer, with contracted volumes representing approximately one-third of the project’s nameplate production capacity.

This materially underpins development of the country’s first domestic quicklime manufacturing operation.

The commitment supports PNG’s buy-local framework and reflects growing demand for reliable, domestically sourced industrial inputs that meet Tier-1 global mining standards.

Cornerstone Project Commitment

Under the multi-year arrangement, supply will commence following Central Lime’s construction and commissioning, subject to customary conditions.

The contracted volumes account for around one-third of nameplate capacity and provide a foundational revenue base as the project advances toward first production.

Delivery will occur under standard commercial terms from the company’s integrated project precinct within a designated Special Economic Zone established to support domestic manufacturing and downstream processing.

All commercial terms—including pricing, escalation mechanisms, and detailed volume scheduling—remain confidential and are consistent with market-based arrangements for long-term industrial supply agreements.

Strategic And ESG Significance

The Central Lime Project is designed to replace imported quicklime currently supplied into PNG from offshore sources.

For Newmont, the agreement enhances supply-chain resilience, reduces exposure to international logistics disruption, and aligns with environmental and social objectives through reduced transport emissions and increased local value creation.

For PNG itself, the project supports local employment, skills development, and the establishment of nationally significant industrial capability consistent with broader economic development and ESG objectives.

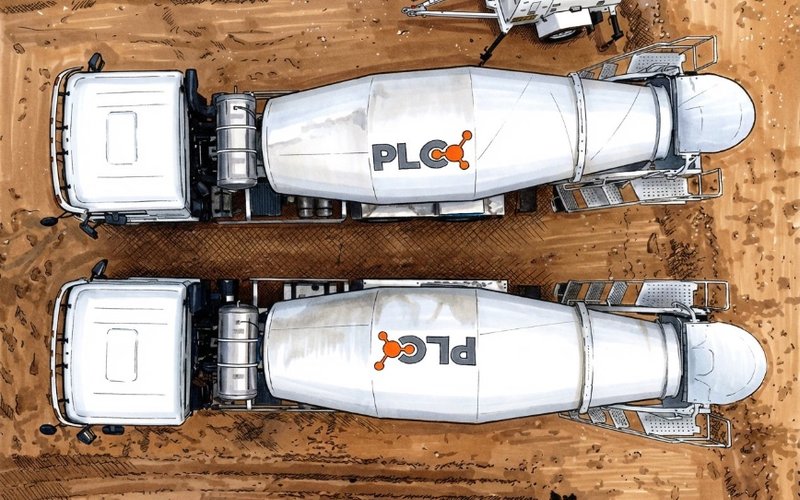

PLC said the agreement demonstrates that PNG-based industrial processing projects can meet the technical, operational, and ESG requirements of Tier-1 global mining companies when developed under disciplined commercial and operating frameworks.

Project Readiness And Outlook

The company continues to work closely with Newmont on operational readiness, quality assurance, and logistics planning as part of broader development activities.

Securing a cornerstone customer supports ongoing discussions with additional domestic and regional customers as the project progresses.

“This agreement validates more than a decade of work to establish domestic quicklime production capable of meeting Tier-1 mining standards, while delivering strong economic, social and environmental outcomes for PNG,” managing director Paul Mulder said.

“With a foundation offtake in place, PLC is well positioned as the Central Lime project advances and shall progress further customer discussions as we move toward first production.”

“This agreement was not about short-term cost savings—it demonstrates our commitment to supporting domestic industry and the broader social and economic benefits that flow from building local capability,” Newmont Lihir general manager Dawid Pretorius added.